Key Horeca Results in Summer 2025

The restaurant industry in Spain has experienced a summer of 2024 full of challenges and opportunities. With a constantly evolving economic landscape and booming tourism, hospitality establishments have had to adapt to new realities and consumer expectations.

For this reason, Delectatech has prepared the report “Summer Restoration Results 2024” which analyzes the performance of establishments in a sample of 10,123 establishments throughout Spain during the months of June, July and August 2024 and 2023. This sample includes the establishments with the highest occupancy, average ticket and diner satisfaction data within Delectatech’s census of more than 250,000 establishments.

Xavier Mallol, CEO and founder of Delectatech, presented the most relevant information of the study in the expected Summer Webinarheld on September 26. The event was attended by great industry leaders such as Dr. Emili Vizuete Luciano, PhD, professor and specialist in business science and international finance and Mr. Jordi Turmo Jardí, CEO and Executive Director of FEDIS HORECA, who in two interviews moderated by Patricia Fernández de Arroyabe, discussed their vision of the year-end closing and the trends that will lead to the next 2025..

Here are some of the most important conclusions drawn from the analysis “Restoration Results in Summer 2024”. Take notes!

When talking about the summer of 2024, we analyze two key aspects: tourism in Spain during this season and the global economic context. These factors are essential for understanding consumer behavior in the Horeca sector and assessing their purchasing power.

Spain has shown signs of moderate economic growthwith a slight increase in year-on-year GDP and controlled inflation during the summer months of 2024.

Although the overall CPI in August was 2.3%, which is close to the levels of the Eurozone (2.2%) and the United States (2.5%), the CPI in the restaurant sector is below the figure for the same period in 2023. This indicates that the persistence of inflation and macroeconomic uncertainty means that consumers are experiencing a steeper increase in the cost of eating out, which could influence their consumption decisions and dampen growth in the Horeca sector.

The real protagonist of this summer has been the tourist boom, a key player in the Spanish economy, reaching record figures this summer: 12% increase in tourists and an increase of 18.6% of total expenditure compared to the same period in 2023. However, tourists have prioritized their budgets on accommodations and transportation, relegating restaurants to second place.

Despite high expectations at the beginning of the summer, the Horeca sector faced several challenges.

According to Delectatech data, average occupation of the establishments disminuyó un 1,2% compared to the previous summer, while the average ticket per guest showed a slight 1.7% increase. Although still growing, this increase is more moderate than in previous months, indicating that consumers are reaching their spending limit in the sector. Even more worrisome is the drop of 1.2% in customer satisfactionsuggesting that many consumers feel they are not getting the value they expect for their money.

Delectatech has developed a new indicator called ”Performance“calculated on the basis of occupancy, satisfaction and average ticket growth. This indicator makes it possible to evaluate the overall performance of catering establishments, obtaining a comparison by type of establishment and region in Spain for the summer of 2024.

As can be seen in the following map, coastal areas and popular tourist destinations have seen a significant increase in occupancy and average ticket, while urban areas have shown more moderate growth. The autonomous communities in Spain with the highest average performance are those of the coastal areas and islandswith the Balearic Islands in the top one, followed by the Canary Islands, Galicia and Catalonia.

First of all, as mentioned in the previous point, the areas with the highest performance in terms of establishments are the ones with the lowest performance. Balearic Islands, the Canary Islands and the coastal areas of northern Spain. These areas are great attractions for sun and beach tourism, and although they have experienced a drop in performance compared to the previous summer, they continue to stand out compared to the inland areas of the country.

Price is also a key attribute. Thus, the Delectatech report notes that the bars bars under €15 per diner record the highest occupancyThe average ticket has increased the most.

With respect to the mayor satisfacciónwe find it in restaurants over €30 per diner on average, especially those with special offers of carnes y arroceswhich are the plates with the best performance.

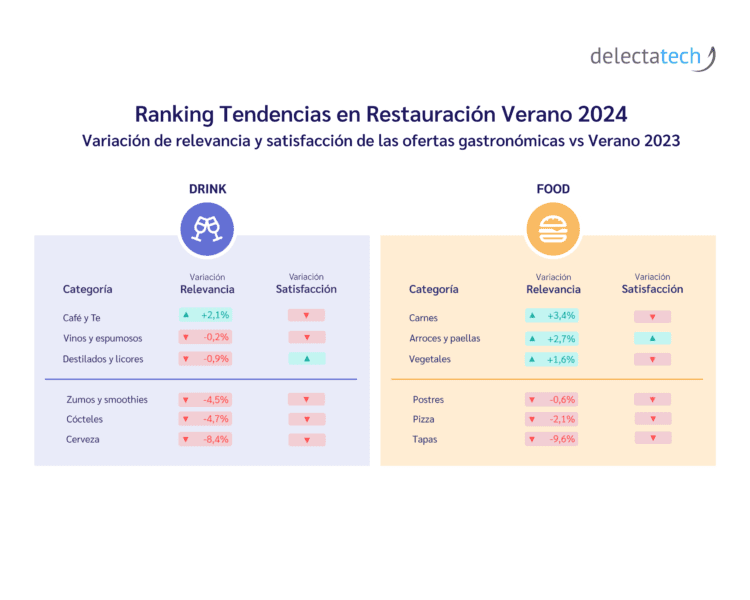

The summer of 2024 has seen significant changes in the culinary preferences of Spanish diners and international tourists. Using our innovative relevance and satisfaction matrix, we have identified the most prominent trends in gastronomic offerings, both in food and beverages.

The report reveals significant changes in culinary preferences this summer. In the area of food, from highest to lowest, las tapas, las pizzas, los postres y las burgers han caído en popularidad a consecuencia del mayor consumo en el hogar a través de delivery, impulsado por eventos deportivos de importancia este año.

On the other hand, more traditional offerings such as meats, rice and vegetables have experienced an increase in relevance.

In terms of beverages, the trend is clear: beverages are losing strength in foodservice and moving towards healthier options. Alcoholic beverages such as cocktails and beers are losing popularity significantly, as are juices and smoothies, both in relevance and satisfaction. Wines and sparkling wines also show a decline in satisfaction, although not as significant in relevance.

As consumers shift to non-alcoholic options, coffee and tea emerge as the only categories in growth, with a 2.1% increase in relevance in online comments, the only category in growth.

Both the rise in beverage prices and the great popularity of home delivery have led to a reduction in comments on beverages in restaurants.

Despite the forecast of a 5% increase in turnover in the restaurant sector this summer, the results have been lower than expected mainly due to price increases and the moderation in international tourist spending.

If you want to delve deeper into this data and discover how to apply it strategically to your business, we invite you to register for free at Food Radar and:

Download Full Report:Access detailed analysis, interactive graphs and personalized recommendations.

Watch the recording of our Webinar:Our experts break down key findings and offer practical insights for your facility.

Delectatech provides actionable data to make informed decisions, as proven in real-world situations. Our report allows you to accurately target your real potential market and engage with the right decision makers to drive your business growth in an ever-evolving market.

Are you ready to boost your business with data-driven insights?Send us a message and we will contact you as soon as possible.