Key Horeca Results in Summer 2025

After a year of major challenges for the Horeca sector in Spain, at Delectatech we have prepared the report “Restaurant Industry Results 2023”, in which we analyze occupancy data from a sample of more than 250,000 establishments. The goal is to evaluate the performance of these establishments over the past year and identify changes in diner behavior compared to 2022.

Xavier Mallol, CEO and founder of Delectatech, presented the most relevant insights from the study in the first webinar of the year, held on February 6. The event featured the participation of prominent industry leaders such as Jacobo Olalla, General Director of Cerveceros de España; Adriana Bonezzi, General Director of Marcas de Restauración; and Pablo Calderón, Director of CRM and Market Intelligence at Makro. In a roundtable moderated by Patricia Fernández de Arroyabe, they discussed their perspectives on how the year closed and how they plan to face 2024.

Below, we share some of the most important conclusions obtained from the “Restaurant Industry Results 2023” analysis. Take note!

While, in general, the economy in the U.S. and the Eurozone has faced an economic slowdown due to inflation-containment measures, the Spanish economy has managed to grow thanks to the boom in tourism, although its GDP growth did not reach the figures of the previous year.

The restaurant sector in Spain recorded a notable 10.68% increase in activity compared to 2022, particularly standing out in the second half of the year, during which occupancy rose by 18.8%. This increase is largely due to the rise in touri

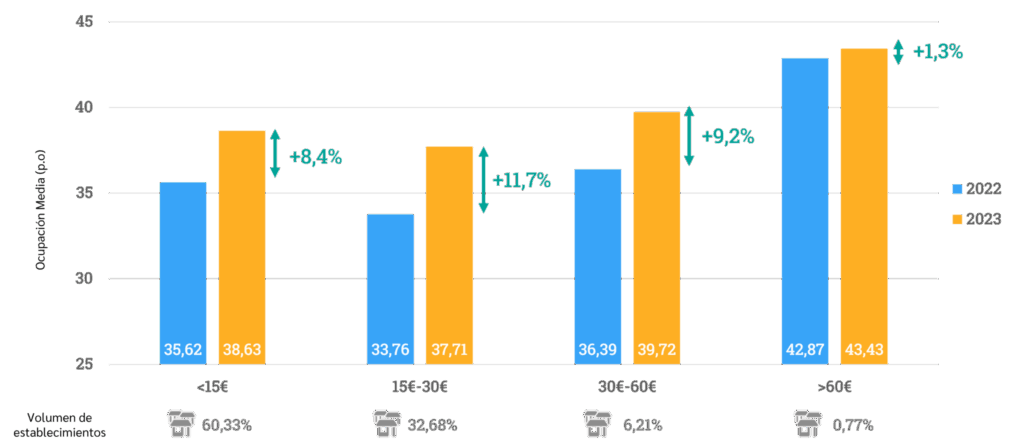

Throughout the year, the restaurants with the highest occupancy growth were those with a ticket price between €15 and €30. However, during the summer season, higher-end restaurants also experienced an increase in occupancy.

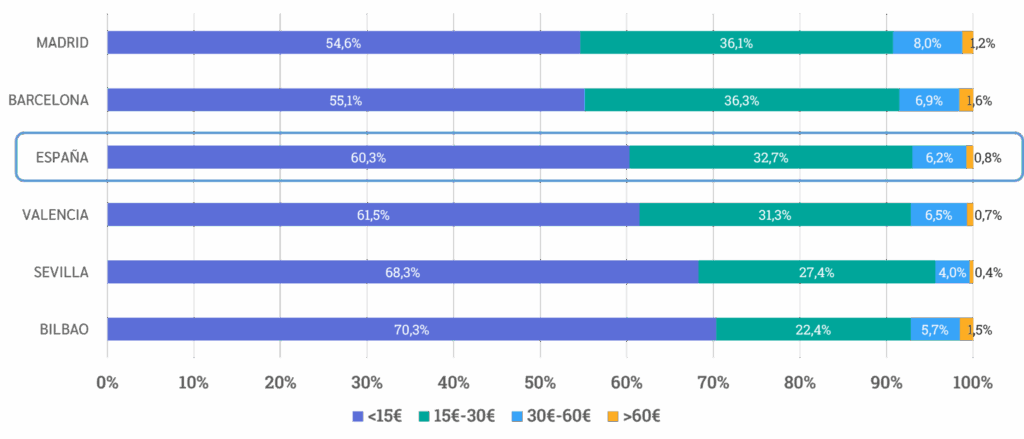

It is important to highlight that 6 out of 10 restaurant establishments in Spain have an average ticket below €15, emphasizing a prevailing trend toward more affordable consumption options. During peak periods of occupancy and tourism, such as summer and Christmas, organized restaurant chains have gained market share over independent establishments.

During 2023, there was a greater preference for weekday consumption compared to weekends, with weekday lunchtime occupancy growing by 15%, thus tripling the increase observed during evenings. This trend reflects diners’ interest in optimizing spending and reducing uncertainty when paying, opting for promotions and fixed menus, especially lunchtime menus. In terms of seasonality, lunchtime occupancy rises in winter, while dinners are preferred in summer.

With the exception of Seville and Granada, Spain’s major cities experienced occupancy growth below the national average of 10.68%, with Seville standing out with an increase of 12.60% thanks to a boost in tourism.

In Barcelona and Seville, establishments with tickets under €15 exceeded the national average in occupancy, while Barcelona also led in the mid-price category (€15-30). Additionally, major capitals such as Madrid, Barcelona, Valencia, Seville, and Bilbao lead the segment of higher-priced establishments above the national average, where restaurants with tickets over €30 are more fully occupied than the Spanish average.

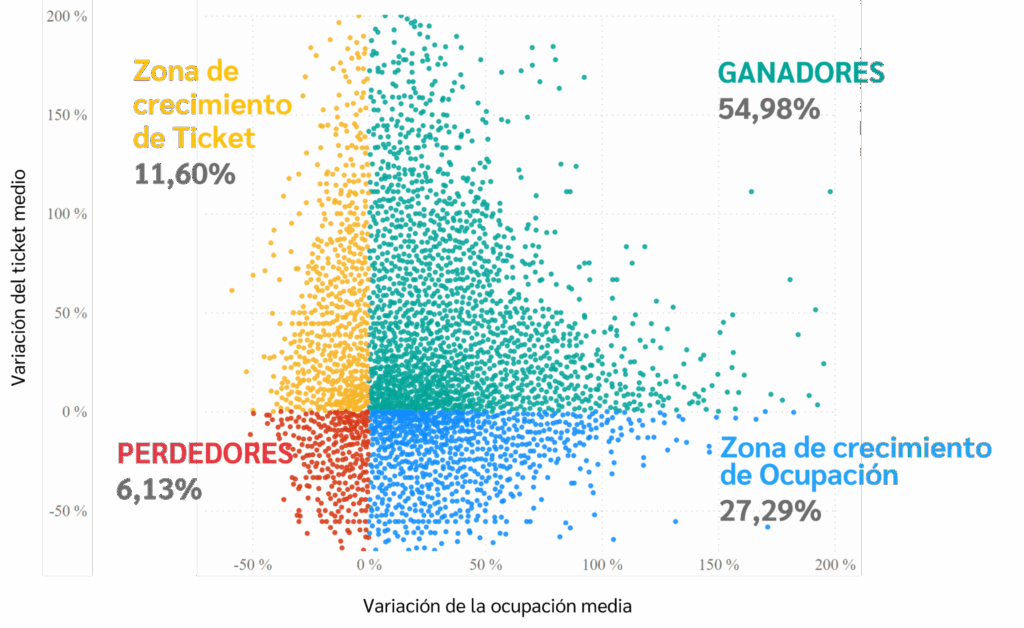

Each point in Delectatech’s performance matrix represents a dining establishment. Winning establishments increased both their average ticket and occupancy during 2023, while losing establishments saw declines in these two KPIs. In the intermediate groups are those that managed to increase occupancy while lowering the average ticket, and those that raised the average ticket but experienced a drop in occupancy.

During 2023, more than half of the establishments (54.98%) fall into the winners’ category, meaning they were busier and increased their average ticket. Only 6.13% of establishments underperformed this year. These strong results are mainly due to significant occupancy growth and higher average tickets driven by inflation. Additionally, winning establishments exhibited more heterogeneous behavior, while the few losing establishments experienced similar declines in both occupancy and average ticket, within a 50% decrease.

The economic outlook for Spain in 2024 anticipates moderate growth due to an increase in domestic demand, which would also imply moderate growth for the hospitality sector this year. The main challenge for the industry will be to capitalize on local consumption in the face of a potential slowdown in tourist flows.