Key Horeca Results in Summer 2025

Summer represents one of the most important periods for the Food Service and hospitality sector due to the significant increase in tourism and leisure demand, which directly impacts annual revenues. However, the summer of 2023 brought unique challenges, such as inflation, geopolitical tensions in neighboring countries, and fluctuations in tourism, forcing the industry to implement various strategies to achieve its desired objectives.

To analyze occupancy and average ticket performance in the restaurant sector during June, July, and August, Delectatech conducted a study using its Artificial Intelligence engine and machine learning algorithms, based on online data from a representative sample of over 19,000 restaurants across Spain.

The results show a significant increase in occupancy, reaching 39.97% in restaurants, surpassing the 36.10% recorded in summer 2022 by 10.72%. In contrast, the average ticket stood at €24.21, reflecting a -2.77% decrease compared to the previous summer, which was €24.90.

These data indicate a shift in diner behavior, with consumers opting for more frequent, lower-cost meals rather than higher-spending gastronomic experiences. In other words, diners went out to eat more often but spent less.

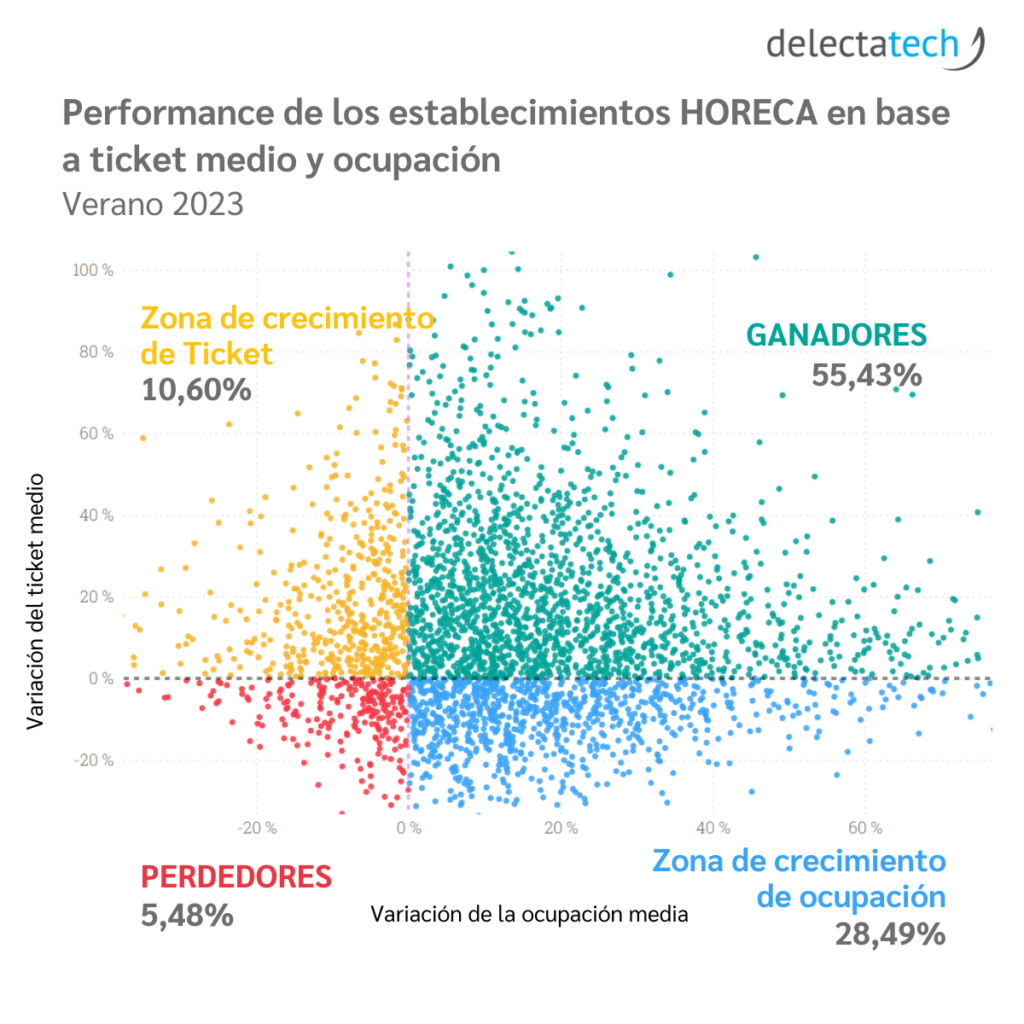

Records indicate that 55.43% of establishments experienced an increase in both key indicators (occupancy and average ticket), higher than the 54.87% in 2022. Specifically, 83.92% of establishments saw an increase in occupancy, while 66.03% reported a rise in the average ticket.

Compared to 2022, summer 2023 showed a variety of behaviors among establishments, with some experiencing double-digit growth in results, while others saw more modest increases. However, unlike the average ticket, occupancy in May 2023 remained similar to May 2022 levels before experiencing a notable increase during the summer season, even surpassing the previous year’s figures.

The highest concentration of establishments that increased both occupancy and average ticket is located in northern Spain: La Rioja, Cantabria, and Asturias. Conversely, regions with the highest density of establishments, such as the Community of Madrid, Catalonia, Andalusia, and Extremadura, saw decreases in both indicators.

Lower-priced establishments, under €20 per diner, emerged as the big winners of the summer, as they had greater capacity to increase both their average ticket and occupancy. In contrast, higher-priced establishments, above €50 per diner, had already reached their pricing limit and were more affected by cautious consumer spending, experiencing a reduction in their average ticket compared to the previous summer.

Regarding business type (bar, restaurant, café, and cocktail bar), there was notable uniformity in performance this summer, with no type standing out distinctly. Overall, more establishments gained in both ticket and occupancy, and although cocktail bars were the majority among those losing both ticket and occupancy, they still improved their performance compared to summer 2022.

From a general perspective, the profile of a winning establishment this summer would be a restaurant located in Catalonia with a price range of €20 or less, belonging to organized dining. Conversely, the profile of a losing establishment would be a restaurant located in the Community of Madrid with a price range between €20–50, belonging to independent dining.

In summary, summer 2023 served as a reminder that the hospitality and Food Service industry is resilient and capable of effectively facing challenges. Diners adopted a “dine more, spend less” strategy, resulting in increased occupancy at establishments, albeit with a slight decrease in the average ticket. As the industry continues to adjust to changing customer demands and economic conditions, it is clear that flexibility and the ability to innovate will be essential for future success.

If you want to explore all this data in more depth, you can now download the full report “Summer 2023 Results”. You just need to register for free on our app, Food Radar.