Key Horeca Results in Summer 2025

Participating in the most important conferences within the Horeca channel and democratizing sector information has been one of Delectatech’s core commitments since its founding. That’s why, on March 6, we attended the Hospitality Innovation Planet (HIP), the annual hospitality innovation fair held in Madrid.

At the event, our CEO and co-founder, Xavier Mallol, had the pleasure of delivering a presentation titled “How Is the Socioeconomic Situation Impacting the Restaurant Sector?”, showcasing the latest results from our studies.

Our studies are based on a census of over 220,000 restaurants in Spain. Among the aspects analyzed are the evolution of the restaurant census and occupancy in Spain and by city, changes in consumption patterns, the polarization of the restaurant sector due to the current socioeconomic situation, and the growth of organized dining.

During the presentation, our goal was to present all results clearly and concisely so that every participant could understand the challenges and opportunities ahead for the Horeca sector. Additionally, we aim to help attendees make better strategic decisions for the future of their businesses.

Below, we summarize the key results obtained in our report:

The pandemic had devastating effects on how consumers approached leisure—this is a fact. Fortunately, positive news is starting to emerge for the sector. Despite inflation and high debt levels, various types of establishments appear to be returning to a growth path.

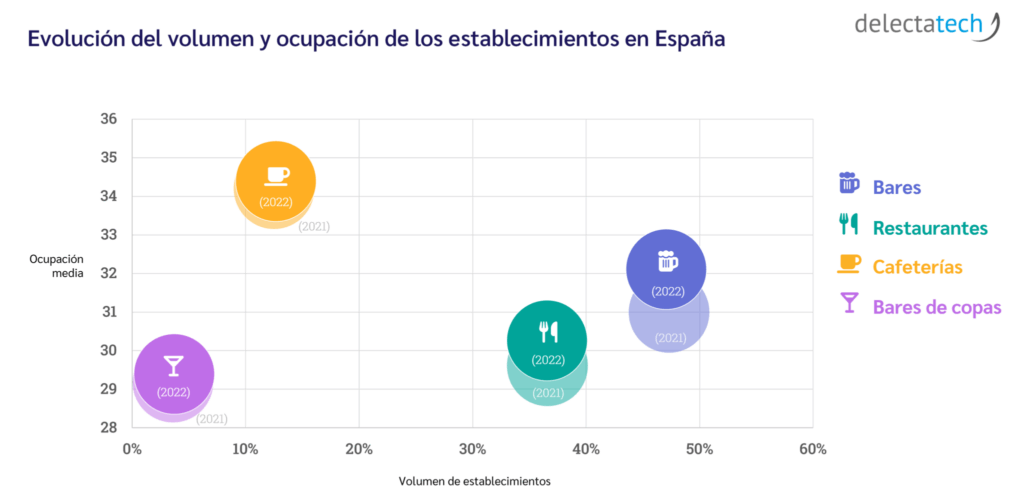

Within our census of over 220,000 establishments, bars remain the largest group (although slightly smaller than last year). Cocktail bars have started to proliferate across Spain, increasing by 3 percentage points in our census representation.

Cafés are the clear winners in terms of total occupancy. They record an average occupancy of 34.39% and have grown by 2.8 percentage points, marking an excellent year for them. Bars, besides being the most numerous, rank second in occupancy with 32.1%, also showing the highest growth compared to last year at +3.6%.

On the less positive side, the report highlights that cocktail bars have lower occupancy, as do restaurants, which register 29.39% and 30.26% respectively—slightly below the overall average.

Restaurants this year have felt the effects of inflation, although it has been lower than the EU average at 8.3%. This has led to higher occupancy in cities with greater purchasing power, with Madrid, Málaga, and Barcelona standing out. In Barcelona, restaurants are the fullest, with an average occupancy of 33.47%.

For bars, average occupancy is more variable. In cities like Seville, figures are modest, while in Barcelona or Vigo, percentages are higher. Overall, Barcelona shows very optimistic occupancy figures.

Cafés perform particularly well in Barcelona and Vigo, with high occupancy rates: 36.95% in Barcelona and 37.62% in Vigo. Cocktail bars are more common in Vigo and Madrid, but again, they fill up more in cities like Barcelona, reaching 32.83% occupancy.

Conclusion: Wealthier cities stand out in business volume, while Barcelona leads in average occupancy. Tourism and purchasing power are key factors driving this trend.

It’s no secret that savings and purchasing power have worsened over the past three years. As a result, many households have reduced their budgets for consumption and leisure, leading to lower average spending in many cities.

However, in terms of occupancy, both independent restaurants and large chains have grown. Large chains have grown twice as much and are more common in major cities like Barcelona and Madrid.

The lower prices of organized dining and the post-pandemic tourism boom have driven higher occupancy in cities most visited by foreign populations, including Marbella, Las Palmas, Palma de Mallorca, and of course, Barcelona and Madrid.

Moreover, less tourist-focused areas like Girona, Aragón, and Cantabria have also seen growth. Clearly, lower prices and simpler, faster dining options are a major attraction for consumers.

You can find all these insights and much more in our full report. To read it, download it for free via our Food Radar app by clicking here.