Key Horeca Results in Summer 2025

The year 2022 has come to an end, and as is customary, it is time to draw conclusions that can help the different players in the Horeca sector. The best way to do this is with data, and that is undoubtedly Delectatech’s mission.

Thanks to our Artificial Intelligence engine, our census of over 250,000 establishments, and tireless statistical work, we bring you all the conclusions on how this Christmas season went in Spain’s restaurant sector. Take note!

Ultimately, the city that recorded the most activity this Christmas is Barcelona. The Catalan capital leads the occupancy statistics with no less than 32.8%.

Among the analyzed cities, those with the highest restaurant occupancy during Christmas after Barcelona (32.8%) were Madrid (31.4%), Sevilla (30.6%), Valencia (30.5%), and Bilbao (30.2%).

Overall, we can observe that restaurant occupancy this Christmas was quite similar to previous years. Only a slight, almost negligible decrease was seen, meaning no city lost more than 5% occupancy, while others even grew.

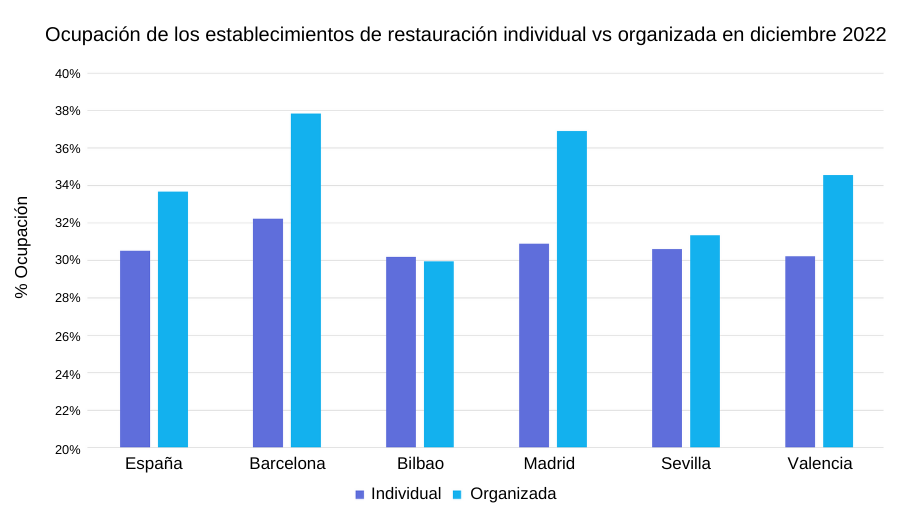

Indeed. During this past Christmas season, we observed growth in organized restaurant chains (groups or franchises) compared to independent businesses (both modern and traditional).

In numbers, the difference between the two is 3.2%. This trend is consistent in the major cities analyzed in our study, except for Bilbao, where occupancy remains higher in independent establishments.

On the other hand, Barcelona and Madrid are the clearest examples of this shift, which favors large franchises. Barcelona stands out in this regard, with the occupancy of such establishments reaching an average of 37.85%.

In conclusion, occupancy in large group or franchise establishments remained stable, while independent restaurants experienced a slight decline of 0.96%.

When interpreting these data, it can be assumed that this is a small example of how the economic crisis affects consumer behavior. Customers tend to choose franchised establishments, which generally offer a lower average ticket.

Another interesting piece of data regarding occupancy is the time of day when Spaniards go out to eat. Overall, restaurants were less busy during lunchtime and the afternoon this past Christmas compared to last year, although evening hours show more optimistic figures.

In fact, establishments improved nighttime occupancy by 0.5% compared to 2021. In Barcelona, this also extends to the late afternoon hours, whereas in Madrid, all time slots showed a decrease.

The time slot with the highest average occupancy remains lunchtime at 35.9%, although significant differences exist between cities. In Barcelona, Bilbao, Sevilla, and Valencia, the preferred time for diners is the evening.

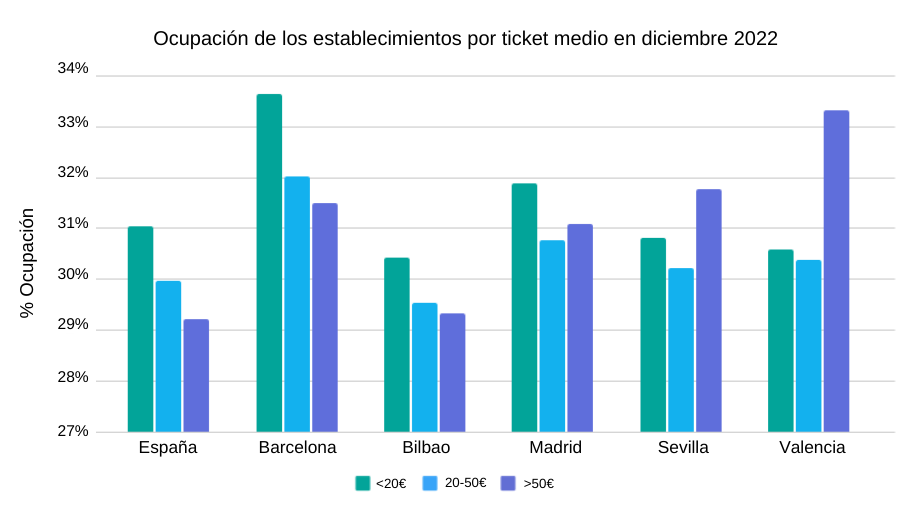

Regarding average ticket value, it is clear that cheaper establishments remain the most popular in cities like Madrid, Bilbao, and Barcelona, with 31% occupancy. These are venues with prices under 20 euros, although their numbers have slightly decreased compared to 2021, down by 1.3%.

Meanwhile, diners in Sevilla and Valencia have shown a stronger preference for mid-to-high-range restaurants. This affects establishments with an average price per person above 50 euros.

At Delectatech, we always strive to ensure the highest accuracy in all published data. This is possible thanks to a broad and ambitious census that includes over 220,000 Spanish restaurants of all types and locations.

Using a mobile device geolocation system along with our AI and Big Data engine, we provide our partner companies with this valuable information. Understanding consumer trends is essential for making the best future decisions and optimizing results.