Key Horeca Results in Summer 2025

The 2022 restaurant industry results are here. After months of work and statistical recording, Delectatech brings you the most relevant information about establishment occupancy and consumer behavior compared to the previous year.

Knowing these data is essential to anticipate strategic decisions, understand how your potential market behaves, and ultimately optimize your activity within the Horeca channel.

That’s why at Delectatech, we have worked hard to create this ambitious analysis that determines the average diner occupancy in Spain. It is based on a census of over 220,000 establishments, with data collected through our AI and Big Data engine.

Here are the most interesting conclusions from the “Restaurant Results 2022” analysis. Take note!

If there is one piece of good news from 2022, it’s this: despite a generally turbulent year, restaurant activity grew significantly. Nationwide, occupancy increased by 3.30% compared to 2021.

The city leading this growth is undoubtedly Barcelona. The Catalan capital recorded the highest occupancy in Horeca establishments, with growth of 9.67%. This figure is almost three times the growth of the rest of Spain.

Regarding how this growth evolved, 2022 remained more stable throughout the months. In contrast, 2021 was a year of strong contrasts, heavily affected by pandemic-related restrictions. February shows the largest difference compared to the previous year, with growth exceeding 12%.

However, the final months of 2022 were somewhat weaker, mainly due to the drastic drop in savings caused by the economic crisis and high inflation. As a result, the last months show a 1.21% decrease in average occupancy.

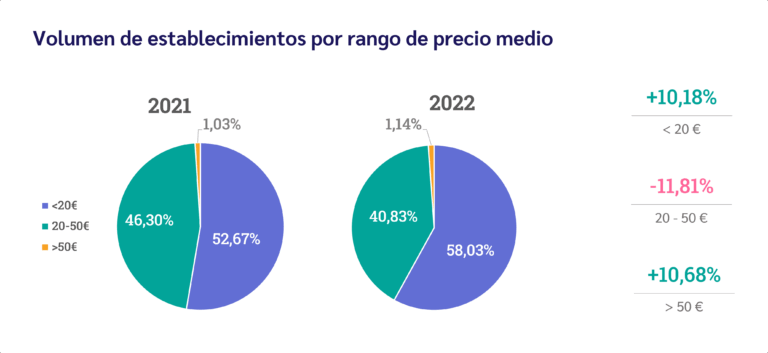

A notable trend from 2022 is the polarization of consumer spending throughout the year. While mid-range restaurants (between €20 and €50) still have a significant presence in the chart (40.83%), their share of establishments has decreased by 11.81% compared to 2021.

On the other hand, the extremes have seen a significant increase. The cheapest category (under €20) dominates nationwide with a 58.03% share, up 10% from the previous year. The most expensive category increased from 1.03% to 1.14% of the average share, also rising by more than 10%.

To identify this growth, we can look at the hottest and coldest months. During the warmer months, the most expensive restaurants were the busiest, while in winter, the cheaper restaurants saw higher occupancy.

Regarding high-end restaurants, Madrid leads with the largest number of establishments priced over €50, which is unsurprising given that it is the city with the highest per capita income. Nevertheless, Bilbao recorded the highest occupancy for expensive restaurants. At the other end of the spectrum are Sevilla and Valencia among the cities analyzed.

Regarding weekly consumption trends, we can observe that weekday occupancy has increased while weekend occupancy has slightly decreased. Overall, dinners have seen significant growth following the lifting of pandemic restrictions.

The main conclusion for 2022 concerning consumer patterns is the substantial increase in occupancy at chain restaurants. While independent restaurants have also grown (3.31% more than in 2021), franchises have doubled this growth with an increase of 7.61%.

These differences are even more pronounced during months with higher tourism. Additionally, the tendency of chain restaurants to offer lower-priced tickets makes them a highly demanded option for tourists throughout the year.

In summary, the restaurant sector is growing in occupancy while consumption is becoming more polarized. These trends are crucial for developing an effective strategy within the Horeca channel.

If you want to explore all this data in depth, you can download the complete report “Restoration Results 2022.” Simply register for free on our Food Radar app.