Key Horeca Results in Summer 2025

In 2024, Spain recorded solid economic growth and achieved performance above the European average driven largely by the tourism sector.

To study it in more detail, Delectatech has prepared the report “Restoration results in 2024” in which it analyzes the performance of establishments throughout Spain during 2024, in addition to making a comparison with 2023 to have a greater vision of the sector. This sample includes the establishments with the most data on occupancy, average ticket and diner satisfaction within the census of more than 250,000 Delectatech establishments, in addition to the analysis of a new KPI: establishment closures by autonomous communities.

Xavier Mallol, CEO and founder of Delectatech, presented the most relevant information from the study in the 2024 restoration results Webinar, held on February 11. The event featured the participation of great leaders in the sector such as Adriana Bonezzi, general director of Marcas de Restauración and Alberto Bueno, manager of Frozen España, who in two interviews moderated by Patricia Fernández de Arroyabe, discussed their vision of how 2024 has gone in restoration and the forecasts for 2025.

Below, we tell you some of the most important conclusions that have been obtained through the analysis “Restoration results in 2024”. Let’s get to it!

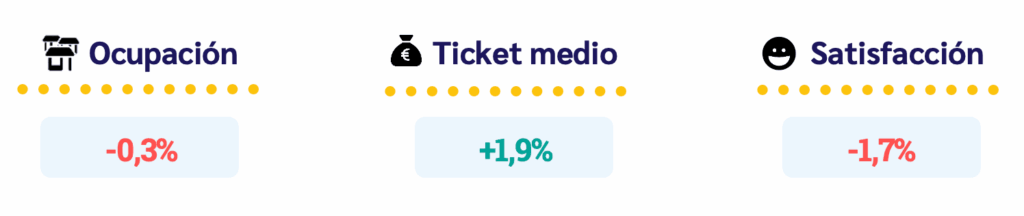

At Delectatech we have measured the year-on-year evolution of three key indicators for 2024 in the hospitality industry: establishment occupancy, average ticket per diner and customer satisfaction.

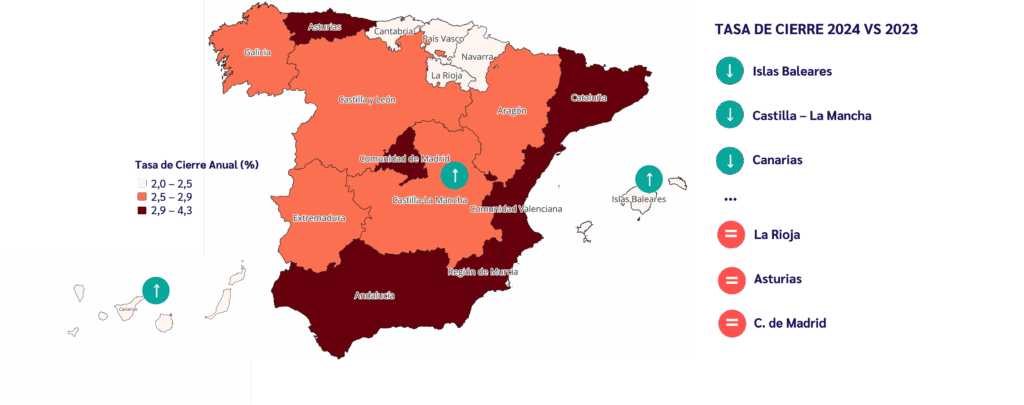

The analysis of monthly closing rate in the HORECA sector during the period 2022-2024 reveals a downward trend, suggesting a gradual improvement in the stability of the sector. In 2022, this rate reached its highest point, while in subsequent years a progressive decrease is observed, with some minor fluctuations that could be attributed to seasonal factors or specific economic events.

In 2022, an average of 40.9 daily closures, which is equivalent to 14,928 establishments closed during the year. In 2023, this figure dropped to 38.7 daily closures, with a total of 14,179 closed establishments within Delectatech’s Horeca census. By 2024, the average daily closures have been reduced to 37.5 establishments. Although data for the last quarter is still missing, if this trend has continued, it is estimated that around 13,687 establishments in Spain will have closed by 2024.

Even so, with respect to 2023 there is a reduction in this rate at the Spanish level. Fewer restaurant businesses are closing, suggesting a gradual improvement in the stability of the sector, driven by adaptation strategies and greater business resilience.

The areas with the highest number of closures in 2024 have been the Community of Madrid, Catalonia, the Valencian Community and the Region of Murcia.

Significant variations are observed in occupancy between the different regions, with clear leadership of the northern areas of the peninsula and islands which have demonstrated the best performance this year, highlighting the Canary Islands, with the best occupancy, followed by the Balearic Islands, Asturias and Catalonia.

On the other hand, the communities that gain more employment this 2024 versus 2023 They are Cantabria, the Basque Country and Navarra; and those that lose the most employment are Extremadura, Andalusia and Castilla-La Mancha.

The autonomous communities with the average bill size the highest per diner in 2024 has been the Basque Country, Navarra, Asturias and the Balearic Islands. We observe that the areas with the highest average ticket are also the ones that have increased it the most this year.

The highest level of satisfaction online of diners by autonomous communities concentrates on the islands and northern Spain. If we compare 2024 versus 2023, Catalonia, the Balearic Islands and Valencia are the communities that have managed to maintain satisfaction the most. On the contrary, the Basque Country, Asturias and Aragón are the communities with the greatest decrease in this category.

As we have mentioned in the previous point, the Balearic and Canary Islands are positioned as the communities with the greatest occupancy during 2024. On the other hand, the northern Spain It has been the area with the greatest growth in establishment occupancy compared to 2023.

Establishments bars have demonstrated a greater capacity to adapt to economic challenges, recording the greatest reduction in the closure rate in 2024.

At the level of average bill size per diner, coffee shops have been the type of establishment that has increased this indicator the most compared to last year.

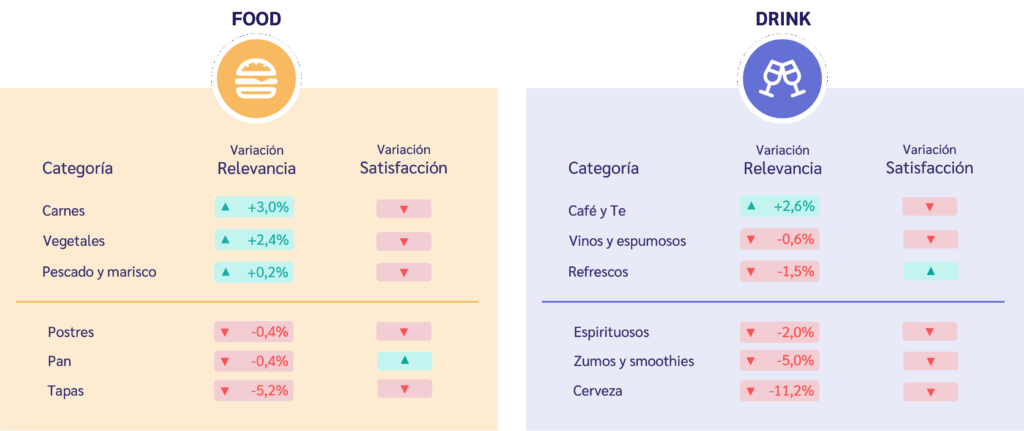

At the level of gastronomic offers, the meats and vegetables They have been the ones that have gained the most popularity in 2024, to the detriment of tapas. In drinks, the coffee It has been the only one that has not lost relevance in restoration.

The analysis of gastronomic offers during 2024 has been carried out using two main KPIs: relevance (popularity of dishes in online comments) and degree of satisfaction (through sentiment analysis of diners’ online opinions).

In the food categories, the meats lead the growth of relevance with an increase of 3% compared to 2023, followed by the vegetables, y finaliza con los fish and seafood that register a slight growth. However, all categories experience a general decrease in satisfaction, which suggests that there is an increasingly demanding and critical consumer.

On the other hand, the categories of dessert (-0,4%), bread (-0.4%) y “tapas” (-5.2%) experience declines in relevance. Particularly noteworthy is the fall in “tapas”, which present the greatest decrease in online popularity compared to the previous year. However, the bread is the only category that shows an increase in satisfaction, which may be thanks to its diversification and adaptation, improving its perception and consumer experience.

In line with the results of “Food”, the loss of relevance of beverages in restaurants continues throughout the year compared to 2023.

The coffee and té They are positioned as the only growing category, with a 2.6% increase in relevance, although their satisfaction has decreased. On the other hand, the soft drinks They present a slight drop in relevance (-1.5%), but they are the only category that shows an improvement in satisfaction.

On the contrary, the beer registra la mayor caída en relevancia con un -11,2% y también experimenta una disminución en satisfacción. De manera similar, los zumos and smoothies (-5.0%) and spirits (-2.0%) show lower demand and a worse consumer experience.

The shift of consumption towards the home through delivery and retail, together with factors such as changes in lifestyle and greater health awareness, have contributed to the reduction in the relevance of drinks in restaurants.

The restaurant sector faces several challenges, such as the relative increase in the price of its services and consumer caution. However, with an adapted offer and the use of innovative strategies, the sector will be able to capitalize on the growth expected for 2025.

Sign up for Food Radar and get all the information you need to make strategic decisions for your business with:

Download Full Report:Access detailed analysis, interactive graphs and personalized recommendations.

Watch the recording of our Webinar:Our experts break down key findings and offer practical insights for your facility.