Key Horeca Results in Summer 2025

With the arrival of summer and the start of the holiday season, the restaurant sector is preparing to welcome numerous diners, both domestic and international, seeking unique gastronomic experiences. However, factors such as rising inflation and reduced savings capacity will significantly influence diners’ spending decisions this summer.

To gain a clear view of potential outcomes for this holiday period, Delectatech conducted a study using its Artificial Intelligence engine and machine learning algorithms, based on online data from a representative sample of over 250,000 restaurants across Spain. This analysis aims to examine diner behavior at the start of summer 2023 compared to the same period last year.

The data shows a significant 6.9% increase in average spend per diner in restaurants during June 2023, reaching €25.08, compared to €23.40 recorded in the same month last year. As is typical in summer months, occupancy also increased by 2.5% over the same period.

Bars and cocktail bars led the increase in spend per diner, with a 7.4% rise. This behavior may be linked to heatwaves, during which diners consume more beverages and less heavy dishes.

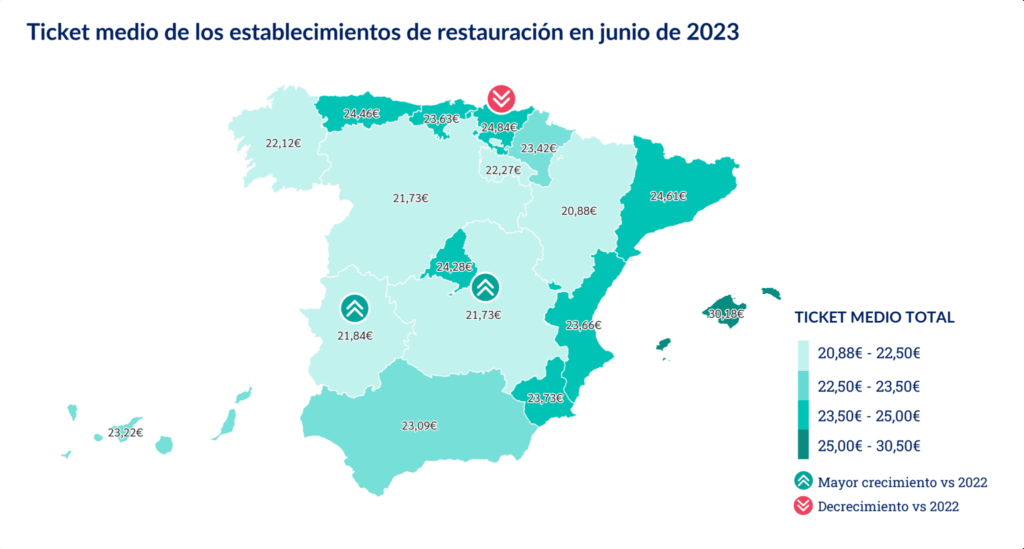

The highest average ticket in June 2023 was recorded in the Balearic Islands, exceeding €30 per diner, followed by the Basque Country (€24.83), Catalonia (€24.61), Asturias (€24.47), and the Community of Madrid (€24.27). Compared to June 2022, there was a pronounced increase in Extremadura and Castilla-La Mancha, while the Basque Country saw a slight decrease of 0.2%.

These data suggest a trend toward the globalization of restaurant spending in Spain: in the more expensive areas, the average ticket has remained stable, while in lower-cost areas, rising costs appear to have had a greater impact on consumers.

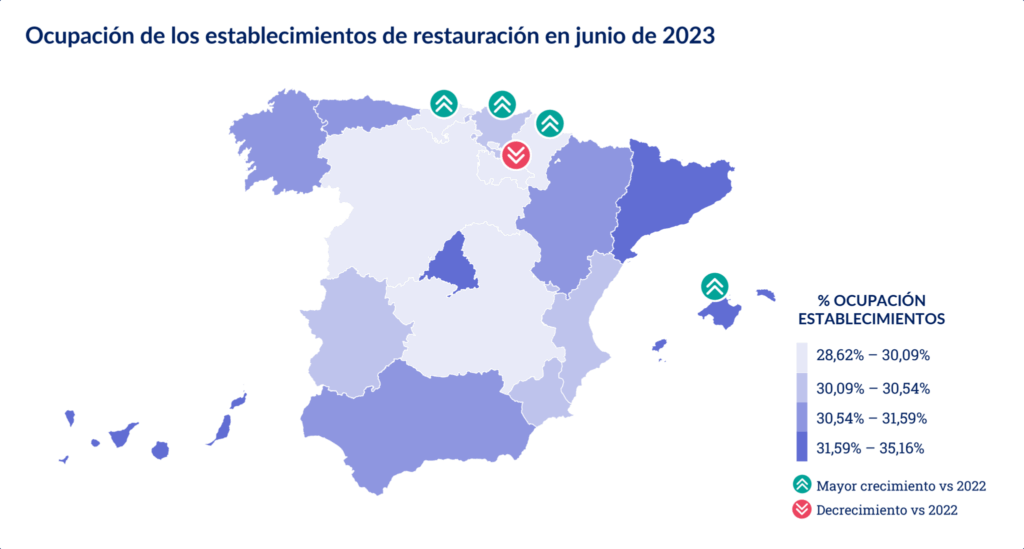

Establishments with an average ticket of €20–50 per diner experienced the largest increase in occupancy, with a significant 3.4% rise compared to the same month last year. Meanwhile, the most expensive establishments (average ticket above €50) and the lowest-priced ones (average ticket below €20) also saw occupancy increases, though to a lesser extent, at 1.3% and 1.7%, respectively.

The autonomous communities with the highest occupancy in June 2023 were the Canary Islands and the Balearic Islands, with average occupancy rates above 35%. They were followed, at some distance, by Catalonia and the Community of Madrid. Compared to June 2022, the areas with the highest growth in occupancy were the Balearic Islands (+4.2%) and northern Spain, including Navarra (+3.2%), the Basque Country (+3.0%), and Cantabria (+3.0%). The only community to experience a decrease in occupancy was La Rioja (-0.4%).

June has served as a reference point to anticipate the rest of summer 2023: positive results in both occupancy and average ticket, driven largely by increased tourism and declining inflation. Data from last year showed that the average ticket in August was 5% higher than in June, while restaurant activity grew by 2.8%.

However, the rise in heatwaves will be an important factor influencing the types of establishments diners choose, their dining times, and menu selections. Likewise, tourism growth will play a decisive role in the sector’s economic performance. Delectatech will continue monitoring the restaurant industry over the coming months and provide updates on changes in occupancy and average spend in Spain’s dining establishments.

These are just some of the insights available in Food Radar. If you want to learn more, register for free and gain valuable information to boost your distribution or restaurant business and make more precise commercial decisions.